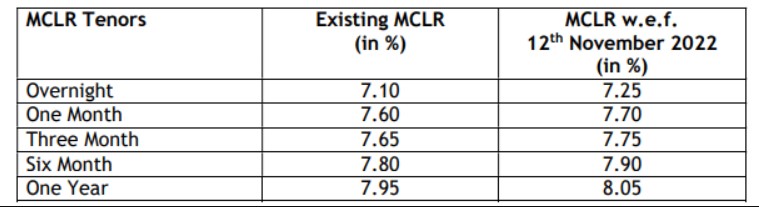

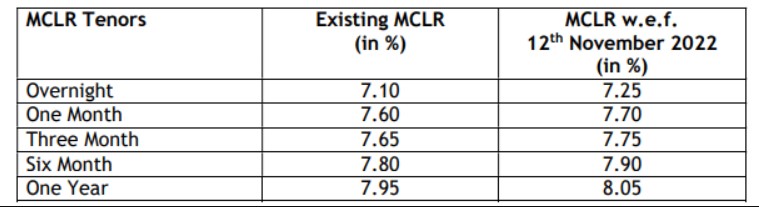

Bank of Baroda have increased their marginal costs of funds-based lending rates (MCLR) on loans.

Banks have been increasing loan interest rates ever since the Reserve Bank of India (RBI) started to hike the repo rate in May 2022. The central bank raised the repo rate by 50 basis points to 5.90% in its most recent monetary policy announcement on September 30, 2022.

Bank of Baroda

If you really like the done-for-you approach, you can scale an agency. You will need to hire and train lots of people, and keeping the work quality high can be a challenge. On the flip side however, finding clients who want a turnkey service is very easy

The overnight MCLR has been hiked by 15 bps to 7.25 percent The one-month MCLR has been hiked by 10 bps to 7.70 percent, while the three and six month MCLR loans will be enhanced by 10 bps percent each to 7.75 percent and 7.95 percent, respectively.